how to pay indiana state sales tax

For those who meet their sales tax compliance deadlines Indiana will offer a discount as well. Sales tax is collected on the sale of merchandise within Indiana.

When Did Your State Adopt Its Sales Tax Tax Foundation

Charge the tax rate of the.

. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Find your Indiana combined state and local tax. Find Indiana tax forms.

Know when I will receive my tax refund. For those collecting less than. If you sell physical products or certain types of services you may need to collect retail sales tax and then pay it to the Indiana State Department of Revenue.

The sales tax due amount is 7 percent of total taxable sales. Completing Form ES-40 and. The total cost of the hotel room is 100 plus 7 plus 10 or 117 per.

Indiana allows merchants to keep a small percentage of the sales tax they collect as a collection discount which serves as compensation for the. The discount varies depending on the size of what was collected. Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the.

What is Indiana state tax. In Indiana there is also a local option sales tax. Indiana businesses have to pay taxes at the state and federal levels.

Add the state sales tax 100 times 07 equals 7. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7. The state-wide sales tax in Indiana is 7.

Indiana has a state sales tax of 675 percent according to state estimates. If you do not pay your property taxes in Indiana. In 2017 that rate fell to 323 and has remained there for the 2019 tax year.

Sales Tax Collection Discounts In Indiana. For the feds youll need to register with the IRS. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

Exact tax amount may vary for different items. Overview of Indiana Taxes Indiana has a flat statewide income tax. The merchants collect the tax on behalf of Indiana and are held.

Indiana has a destination-based sales tax system so you have to pay attention to the varying tax rates across the state. The base state sales tax rate in Indiana is 7. But for the Department of Revenue you can do it here.

2022 Indiana state sales tax. Then figure the innkeepers tax of 10 percent. Local tax rates in Indiana range from 700 making the sales tax range in Indiana 700.

100 times 10 equals 10.

How To File And Pay Sales Tax In Indiana Taxvalet

Indiana State Tax Golddealer Com

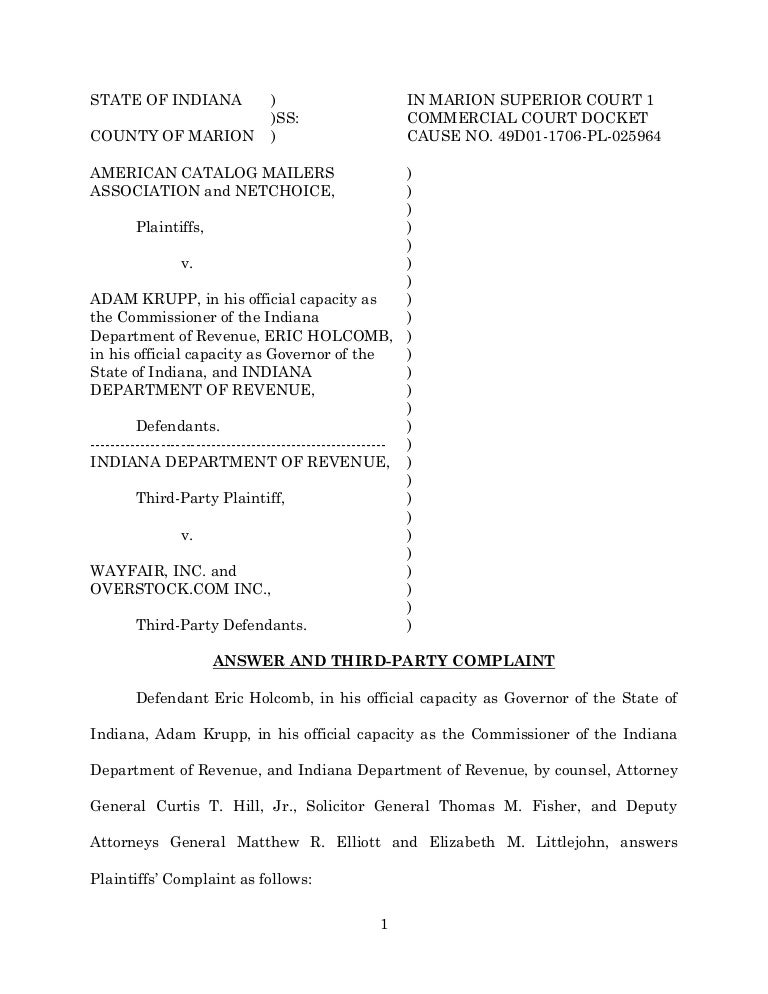

Indiana Files Online Sales Tax Suit

Does Indiana Tax Its Residents More Or Less Than Other States Carroll County Comet

/cloudfront-us-east-1.images.arcpublishing.com/gray/6YFVU2A76NGWNHAV2HN5NJL7A4.png)

Sales Tax On Diapers In Indiana Suspended Until July 2023

Indiana Sales Tax Information Davo Technologies

Indiana Lawmakers Could Debate Sales Business Tax Changes Ap News

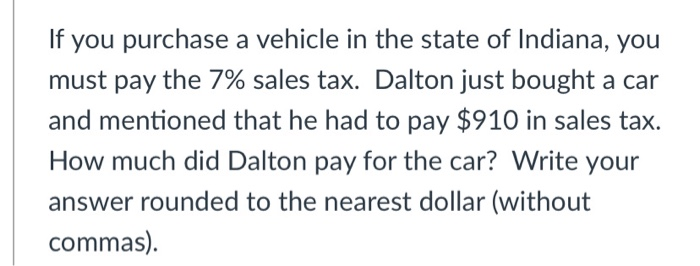

Solved What Is 20 Of 90 Write Your Answer Rounded To The Chegg Com

How We Got Here From There A Chronology Of Indiana Property Tax Laws

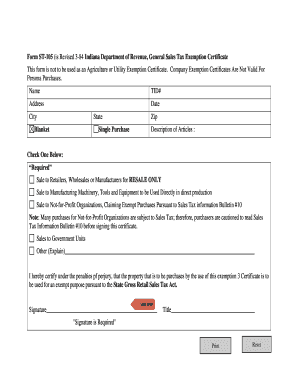

Fillable Online Indiana General Sales Tax Exemption Certificate Form Rev384 Fax Email Print Pdffiller

Indiana Sales Tax Exemptions Agile Consulting Group

Indiana Tax Sales Tax Liens Youtube

How An Online Sales Tax Ruling Could Hurt Smaller Businesses In Indiana

Indiana Makes Moves To Force You To Pay Online Sales Tax

Indiana Dor Prepares To Move Forward With Out Of State Sales Tax

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

How To File And Pay Sales Tax In Indiana Taxvalet

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Are You Cash Negative At The Inception Of A Bhph Deal Due To Sales Tax Lhph Capital